| 10 | | Stericycle, Inc. - 2019 Proxy Statement10

STOCK OWNERSHIP Stock Ownership of Certain Stockholders Stock Ownership of Certain Stockholders The following table provides information about the beneficial ownership of our common stock by each person who was known to us to be the beneficial owner as of the record date (March 31, 2017)28, 2019) of more than 5% of our outstanding common stock: | | Name and Address of Beneficial Owner | | | Amount and Nature of

Beneficial Ownership | | | | Percent of

Class | | | Amount and Nature of

Beneficial Ownership | | | Percent of

Class | | The Vanguard Group, Inc.(1)

100 Vanguard Boulevard

Malvern, Pennsylvania 19355 | | | 7,843,149 | | | | 9.2 | % | | | 8,172,270 | | | | 9.02 | % | | T. Rowe Price Associates, Inc.(2)

100 E. Pratt Street

Baltimore, Maryland 21202 | | | 6,824,010 | | | | 8.0 | % | | | 9,181,105 | | | | 10.1 | % | | BlackRock, Inc.(3)

55 East 52ndStreet

New York, New York 10055 | | | 5,936,937 | | | | 6.9 | % | | | 7,616,828 | | | | 8.4 | % | | Baillie Gifford & Co.(4)

Calton Square

1 Greenside Row

Edinburgh EH1 3AN

Scotland | | | | 5,393,108 | | | | 5.95 | % | |

| (1) | The shares shown as beneficially owned are derived from theBased on a Schedule 13G/A (Amendment No. 6) that The Vanguard Group, Inc. filed with the SEC on February 10, 2017. The Schedule 13G indicates that The11, 2019, the Vanguard Group Inc. hadhas sole voting power over 131,854with respect to 41,023 shares, shared voting power over 14,089with respect to 10,221 shares, sole dispositive power over 7,700,586with respect to 8,129,059 shares and shared dispositive power over 142,563with respect to 43,211 shares.

|

| (2) | The shares shown as beneficially owned are derived from theBased on a Schedule 13G that T. Rowe Price Associates, Inc.13G/A filed with the SEC on February 7, 2017. The Schedule 13G indicates that T.11, 2019, T Rowe Price Associates, Inc. hadhas sole voting power over 2,420,236with respect to 3,711,270 shares and sole dispositive power over 6,811,794with respect to 9,161,119 shares.

|

| (3) | The shares shown as beneficially owned are derived from theBased on a Schedule 13G/A (Amendment No. 3) that BlackRock, Inc. filed with the SEC on January 27, 2017. The Schedule 13G indicates that Blackrock,February 6, 2019, BlackRock, Inc. hadhas sole voting power over 5,231,205with respect to 7,204,157 shares, and sole dispositive power over 5,936,937with respect to 7,616,828 shares.

|

Stericycle, Inc. - 2017 Proxy Statement 11

| (4) | Based on a Schedule 13G filed with the SEC on February 8, 2019, Baillie Gifford & Co. has sole voting power with respect to 4,610,118 shares, and sole dispositive power with respect to 5,393,108 shares. |

| | | | | | Stericycle, Inc. - 2019 Proxy Statement | | | 11 | |

ITEM 1 | Election of Directors |

ITEM 1 Election of Directors for aOne-Year Term Our Board is currently composed of 12thirteen directors. Mr. Alutto, Mr. Brown and Mr. Miller are not standing forre-election at the Annual Meeting. Therefore, effective as of the annual meeting of shareholders, our board of directors has fixed the size of the board at ten. With the exception of Mark C.Ms. Miller, our Chairman of the Board, and Charles A. Alutto, ourcurrent President and Chief Operating Officer and our Chief Executive Officer Elect, all of our directorsdirector nominees are outside directors (i.e., directors who are neither officersan officer nor employeesan employee of ours). Mr. Miller transitioned from the roleMurley, one of Executiveour independent directors, was elected as Chairman of the Board to Chairman of the Board immediately following our 2016 Annual Meeting of Stockholders. Although Mr. Miller is no longer an officer of the Company, he continues to be an employee of the Company and therefore is not an outside director.in March 2018. The Board has determined that all of our outside directors are independent under the applicable rules of the SEC and listing standards of the NASDAQNasdaq Global Select Market (“NASDAQ”Nasdaq”). Although all of the nominees proposed for election to our board of directors are currently members of our Board, Ms. Miller, Mr. Hackney, Ms. Hagen, Mr. Hooley and Ms. Priestly have not previously been elected by our stockholders. Ms. Miller was elected to our board in connection with her appointment as Chief Executive Officer. Mr. Hackney, Ms. Hagen, Mr. Hooley and Ms. Priestly were identified by the Nominating and Governance Committee as potential directors and were recommended by the Nominating and Governance Committee after it completed its interview and vetting process. Each director elected at the Annual Meeting will hold office until our 20182020 Annual Meeting of Stockholders or until his or her successor is duly elected and qualified. Voting in Uncontested Director Elections Under our bylaws, a nominee for election as a director must receive a majority of the votes cast in order to be elected as a director in an uncontested election (an election in which the number of nominees for election is the same as the number of directors to be elected). In other words, the nominee must receive more “for” votes than “against” votes, with abstentions and brokernon-votes not having any effect on the voting. If a nominee for election as a director is an incumbent director and the nominee is notre-elected, Delaware law provides that the director continues to serve as a “holdover” director until his successor is elected and qualified or until he resigns. Under our bylaws, an incumbent director who is notre-elected is required to tender his resignation as a director. Our Nominating and Governance Committee will review the circumstances and recommend to the Board whether to accept or reject the director’s resignation or take any other action. The Board is required to act on this recommendation and publicly disclose its decision and the rationale behind its decision within 90 days from the date that the election results are certified. Changes to OurBoard Refreshment

A number of changes have occurred in our Company’s Board of Directors over the past several years as part of our continuing efforts to ensure that our Board has the right skills and experience to best oversee management and the execution of our strategy and the associated risks. Since the beginning of 2017, Ms. Miller, Mr. Murley, Mr. Anderson, Mr. Hackney, Ms. Hagen, Mr. Hooley and Ms. Priestly have all joined the Board. Mr. Murley, Mr. Anderson and Ms. Priestly all bring substantial experience in finance, accounting and financial reporting. Ms. Priestly, Mr. Hackney, Ms. Hagen and Mr. Hooley each have broad experience in business transformation. In addition, since the beginning of 2017, several long-tenured directors have stepped down from the Board. The average tenure of the independent nominees for election as a director is less than 3 years. Further, with respect to Board leadership succession, Mr. Murley was elected as independent Chairman of the Board in March 2018 and new Chairs of the Audit, Compensation and Nominating and Governance Committees were elected in 2016 and 2017. | | | | 12 | | Stericycle, Inc. - 2019 Proxy Statement |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM Board Refreshment Messrs. Dammeyer and Hall will not be standing for re-election at the Annual Meeting. The Company thanks Messrs. Dammeyer and Hall for their many years of distinguished service to the Company. As previously disclosed Messrs. Anderson and Murley joined our Board in January 2017 and will be standing for election at the Annual Meeting. Messrs. Anderson and Murley were first identified as candidates for directors by certain membersA snapshot of our outside directors. Should all2019 director nominees be elected to the Board at the Annual Meeting, the numberis set forth below.

Snapshot of directors constituting the Board will be decreased from 12 to 10 directors.2019 Director Nominees The nominees for Director are overwhelmingly independent. The nominees for Director also represent diverse points of view that contribute to a more effective decision-making process. | | | | | | | | | | | Board Independence | | Board Tenure | | Diversity of Director Nominees | | | | | | 10 Directors | | All Director nominees are independent except the CEO Elect | | Tenure of independent Director nominees (years of consecutive service) | | 60% | | Gender, ethnic or other minority representation | | | | |

| | 2.5 years | | Average Tenure | |  | |  |

| | | | | | Stericycle, Inc. - 2019 Proxy Statement | | | 13 | |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM Nominees for Director Nominees for Director ROBERT S. MURLEY The following table provides information about the nominees for election as directors.

Director since January 2017 Age 69 Nominee | Position with the Company | Age | Mark C. Miller | Chairman of the Board of Directors | 61 | Jack W. Schuler | Lead Director | 76 | Charles A. Alutto | President, Chief Executive Officer, Director | 51 | Brian P. Anderson | Director | 66 | Lynn D. Bleil | Director | 53 | Thomas D. Brown | Director | 69 | Thomas F. Chen | Director | 67 | Experience:Robert S. Murley | Director | 67 | John Patience | Director | 69 | Mike S. Zafirovski | Director | 63 |

Stericycle, Inc. - 2017 Proxy Statement 12

MARK C. MILLER

Director Since May 1992

Age 61

Mark C. Miller has served as our Chairman since May 2016 and prior to that he was our Executive Chairman since January 2013. Mr. Miller has been a director since May 1992. He became our Chief Executive Officer in May 1992 and Chairman of the Board of Directors in August 2008, and served in each of those roles until January 2013. From May 1989 until joining us, Mr. Miller served as vice president for the Pacific, Asia and Africa in the international division of Abbott Laboratories, a diversified health care company, which he joined in 1976 and where he held a number of management and marketing positions. Mr. Miller serves as a director of Accelerate Diagnostics, Inc., a developer of automated diagnostics systems, and formerly served as a director of Ventana Medical Systems, Inc., a developer and supplier of automated diagnostic systems. He received a B.S. degree in computer science from Purdue University, where he graduated Phi Beta Kappa.

JACK W. SCHULER

Director Since January 1990

Age 76

Jack W. Schuler has served as the Lead Director of our Board of Directors since August 2008 and served as our Chairman of the Board from January 1990 until becoming Lead Director. From January 1987 to August 1989 he served as president and chief operating officer of Abbott Laboratories, where he also served as a director from April 1985 to August 1989. Mr. Schuler serves as a director of Quidel Corporation, a developer and manufacturer of point-of-care diagnostic tests, and Accelerate Diagnostics, Inc., a developer of automated diagnostics systems, and formerly served as chairman of the board of directors of Ventana Medical Systems, Inc., and as a director of Medtronic, Inc., Amgen Incorporated, Chiron Corporation, Elan Corporation, plc, Hansen Medical, Inc., and ICOS Corporation. He is a co-founder of Crabtree Partners LLC, a private investment firm in Lake Forest, Illinois, and is a former trustee of Carleton College. Mr. Schuler received a B.S. degree in mechanical engineering from Tufts University and an M.B.A. degree from the Stanford University Graduate School of Business Administration.

CHARLES A. ALUTTO

Director Since November 2012

Age 51

Charles A. Alutto has served as our President and Chief Executive Officer since January 2013 and as a director since November 2012. He joined us in May 1997 following our acquisition of the company where he was then employed. He became an executive officer in February 2011 and served as President, Stericycle USA. He previously held various management positions with us, including vice president and managing director of SRCL Europe and corporate vice president of our large quantity generator business unit. Mr. Alutto received a B.S. degree in finance from Providence College and an M.B.A. degree in finance from St. John’s University.

BRIAN P. ANDERSON

Director Since January 2017

Age 66

Brian P. Anderson has served as a director since January 2017. Mr. Anderson served Senior Vice-President and Chief Financial Officer of OfficeMax Incorporated from 2004 to 2005 and as Senior Vice President and Chief Financial Officer of Baxter International from 1997 to 2004. He joined Baxter in 1991, as Vice President, Corporate Audit, became Corporate Controller in 1993 and then Vice President, Finance in 1997. Before joining Baxter, he spent 15 years with Deloitte Consulting LLP in the Chicago office and the Washington, D.C. office as an Audit Partner. He is a member of the Board of Directors of W. W. Grainger, Inc., PulteGroup, Inc., James Hardie Industries plc, and The Nemours Foundation. He currently serves as Chairman of The Nemours Foundation, Chairman of the Audit Committees of James Hardie Industries plc and PulteGroup, and is the former Lead Director and Audit Committee Chairman of W. W. Grainger, Inc. Mr. Anderson was recently elected to The Governing Board of the Center for Audit Quality and served on the Board of A.M. Castle & Co. from 2005 to 2016, as Audit Committee Chairman (2005-2010) and Chairman of the Board 2010-2016.

LYNN D. BLEIL

Director Since May 2015

Age 53

Lynn D. Bleil has served as a director since May 2015. Ms. Bleil was the leader of the West Coast Healthcare Practice of McKinsey & Company, a management consulting firm. Ms. Bleil was also a leader of McKinsey’s worldwide Healthcare Practice. She retired in November 2013 as a Senior Partner (Director) in the Southern California Office of McKinsey. During her more than 25 years with McKinsey, she worked exclusively within the healthcare sector, advising senior management and boards of leading companies on corporate and business unit strategy, mergers and acquisitions and integration, marketing and sales, public policy and organization. Ms. Bleil also serves as a director of DST Systems, Inc., a financial and health services information technology company, Sonova Holdins AG, a global leader in hearing aids and cochlear implants, and Intermountain Healthcare’s Park City Medical Center, a non-profit healthcare organization. Ms. Bleil holds a B.S.E. degree in Chemical Engineering from Princeton University and an M.B.A. degree from the Stanford Graduate School of Business.

THOMAS D. BROWN

Director Since May 2008

Age 69

Thomas D. Brown has served as a director since May 2008. From 1974 until his retirement in 2002, Mr. Brown held various sales, marketing and management positions at Abbott Laboratories, where he served as a senior vice president and president of the diagnostics division from 1998 to 2002 and as corporate vice president for worldwide commercial operations from 1993 to 1998. He is a director of Quidel Corporation and Accelerate Diagnostics, Inc., and formerly served as a director of Ventana Medical Systems, Inc. and Cepheid Inc. Mr. Brown received a B.A. degree from the State University of New York at Buffalo.

Stericycle, Inc. - 2017 Proxy Statement 13

THOMAS F. CHEN

Director Since May 2014

Age 67

Thomas F. Chen has served as a director since May 2014. Mr. Chen served as senior vice president and president of international nutrition of Abbott Laboratories before retiring in 2010. During his 22-year career at Abbott, Mr. Chen served in a number of roles with expanded responsibilities, primarily in Pacific/Asia/Africa where he oversaw expansion into a number of emerging markets. Prior to Abbott, he held several management positions at American Cyanamid Company, which later merged with Pfizer. He is a director of Baxter International Inc. and formerly served as a director of Cyanotech Corporation. Mr. Chen received a Bachelor’s degree in International Business from National Cheng Chi University in Taipei, Taiwan, and an M.B.A. degree from Indiana University.

ROBERT S. MURLEY

Director Since January 2017

Age 67

Robert S. Murley has served as a director since January 2017.March 2018. Mr. Murley is a Senior Adviser to Credit Suisse, LLC, a financial services company. From 1975 to April 2012, Mr. Murley was employed by Credit Suisse, LLC and its predecessors. In 2005, he was appointed Chairman of Investment Banking in the Americas. Prior to that time, Mr. Murley headed the Global Industrial and Services Group within the Investment Banking Division, as well as the Chicago investment banking office. He was named a Managing Director in 1984 and appointed a Vice Chairman in 1998. Mr. Murley is a member of the board of directors of Health Insurance Innovations Inc., of privately held Brown Advisory Incorporated, and of the board of advisors of Harbour Group. He was formerly on the board of directors of Stone Energy Corporation and Apollo Education Group, Inc. Mr. Murley is an Emeritus Charter Trustee of Princeton University, a Trustee and the former Chairman of the Board of the Educational Testing Service in Princeton, New Jersey, is Vice Chairman of the Board of the Ann & Robert Lurie Children’s Hospital of Chicago and Chair of the Board of the Lurie Children’s Foundation, is a Trustee of the Museum of Science & Industry in Chicago, Illinois, is Chairman of the Board of the UCLA Anderson Board of Advisors.

Skills & Qualifications: Mr. Murley holdsMurley’s existing public company board experience, his deep knowledge of the capital markets and the economy, and his extensive experience leading and advising a Bachelorrange of Arts from Princeton University,businesses across multiple industries make him a Mastervaluable member of Business Administration from the UCLA Anderson School of Management, and a Master of Science from the London School of Economics and Political Science.Board. CINDY J. MILLER JOHN PATIENCE

Director since February 2019 Age 56 Experience: Ms. Miller joined Stericycle as President and Chief Operating Officer in October 2018. She was named President and Chief Executive Officer effective May 2019. Ms. Miller previously served as President, Global Freight Forwarding for United Parcel Service (UPS) from April 2016 to September 2018 and as President of UPS’s European region from March 2013 to March 2016. Skills & Qualifications: Ms. Miller brings to the Board deep knowledge and experience in business transformation and change management, operations management, strategy, logistics, and international business. BRIAN P. ANDERSON

Director since January 2017 Age 68 Experience: Mr. Anderson served as Senior Vice-President and Chief Financial Officer of OfficeMax Incorporated from 2004 to 2005 and as Senior Vice President and Chief Financial Officer of Baxter International from 1997 to 2004. He joined Baxter in 1991, as Vice President, Corporate Audit, became Corporate Controller in 1993 and then Vice President, Finance in 1997. Before joining Baxter, he spent 15 years with Deloitte in the Chicago office and the Washington, D.C. office as an Audit Partner. He is a member of the Board of Directors of W. W. Grainger, Inc., PulteGroup, Inc., and James Hardie Industries plc. He currently serves as Chairman of the Audit Committee of James Hardie Industries plc, and is the former Chairman of the Nemours Foundation, Chairman of the Audit Committee of the Pulte Group and Lead Director and Audit Committee Chairman of W. W. Grainger, Inc. Mr. Anderson serves on The Governing Board of the Center for Audit Quality and served on the Board of A.M. Castle & Co. from 2005 to 2016, as Audit Committee Chairman (2005-2010) and Chairman of the Board 2010-2016. Skills & Qualifications: Mr. Anderson brings to our Board his significant experience as a chief financial officer of two large multinational companies,in-depth knowledge with respect to the preparation and review of complex financial reporting statements, and experience in risk management and risk assessment. LYNN D. BLEIL

Director Since May 2015 Age 55 Experience: Ms. Bleil was the leader of the West Coast Healthcare Practice of McKinsey & Company, a management consulting firm. Ms. Bleil was also a leader of McKinsey’s worldwide Healthcare Practice. She retired in November 2013 as a Senior Partner (Director) in the Southern California Office of McKinsey. During her more than 25 years with McKinsey, she worked exclusively within the healthcare sector, advising senior management and boards of leading companies on corporate and business unit strategy, mergers and acquisitions and integration, marketing and sales, public policy and organization. Ms. Bleil also serves as a director of Amicus Therapeutics Inc., a biotechnology company, Alcon AG, Sonova Holdings AG, a global leader in hearing aids and cochlear implants, and Intermountain Healthcare’s Park City Medical Center, anon-profit healthcare organization. She was formerly a director of DST Systems, Inc. Skills & Qualifications: Ms. Bleil brings to the Board significant experience in the healthcare industry, as well as commercial expertise and expertise in corporate strategy, mergers and acquisitions, and financial reporting, compliance and risk management. | | | | 14 | | Stericycle, Inc. - 2019 Proxy Statement |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM Nominees for Director THOMAS F. CHEN

Director Since May 2014 Age 69 Experience: Mr. Chen served as senior vice president and president of international nutrition of Abbott Laboratories before retiring in 2010. During his22-year career at Abbott, Mr. Chen served in a number of roles with expanding responsibilities, primarily in Pacific/Asia/Africa where he oversaw expansion into emerging markets. Prior to Abbott, he held several management positions at American Cyanamid Company, which later merged with Pfizer, Inc. Mr. Chen currently serves as a director of Baxter International Inc. and an advisor to Cooperation Fund, a partnership between Goldman Sachs and the sovereign fund, China Investment Corporation, to bolster U.S. manufacturers’ market presence in China. Mr. Chen previously served as a director of Cyanotech Corporation. Skills & Qualifications: With his extensive international business experience in pharmaceutical, hospital products and nutritionals through his22-year career at Abbott, Mr. Chen provides our Board with a distinct global perspective resulting from his experience with diverse geographies and healthcare products. He also provides our Board with significant operational, strategy, mergers and acquisitions, healthcare industry, governmental and regulatory, and commercial expertise. J. JOEL HACKNEY, JR.

Director Since March 19892019 Age 6949 John PatienceExperience: Mr. Hackney has served as a director since our incorporation in March 1989. He is a co-founder and partner of Crabtree Partners LLC, a private investment firm in Lake Forest, Illinois, which was formed in June 1995. He is currentlybeen the chairman of the boardChief Executive Officer and a director of Accelerate Diagnostics,nThrive, Inc., a developerrevenue cycle management company providing medical billing and coding, business analytics and advisory services, since January 2016. Previously, he was the Chief Executive Officer and a director of automated diagnostics systems.AVINTV from June 2013 to November 2016.

Skills & Qualifications: With more than 25 years of experience leading both private and public companies domestically and abroad, Mr. Hackney brings to our Board deep expertise in driving business transformation and profitable growth. VERONICA M. HAGEN

Director Since June 2018 Age 73 Experience: From 2007 until her retirement in 2013, Ms. Hagen served as Chief Executive Officer of Polymer Group, Inc. and served from 2007 to 2015 as a Director. She also served as President of Polymer Group, Inc. from January 2011 until her retirement in 2013. Prior to joining Polymer Group, Inc., Ms. Hagen was the President and Chief Executive Officer of Sappi Fine Paper, a division of Sappi Limited. She has served as Vice President and Chief Customer Officer at Alcoa Inc. and owned and operated Metal Sales Associates. She is a Director of American Water Works Company, Inc., Newmont Mining Corporation and The Southern Company. Skills & Qualifications: Ms. Hagen brings business transformation expertise, senior leadership experience, corporate governance knowledge and experience, environmental matters experience and risk management experience. Ms. Hagen’s experience as chief executive officer of two global companies allows her to contribute key valuable insights to our Board regarding operations management, customer service and strategic planning. STEPHEN C. HOOLEY

Director Since March 2019 Age 56 Experience: Mr. Hooley served as Chairman, Chief Executive Officer and President of DST Systems, Inc. from July 2014 to April 2018. He was Chief Executive Officer and President of DST Systems from September 2012 to July 2014 and President and Chief Operating Officer from July 2009 to September 2012. He was previously the President and Chief Executive Officer of Boston Financial Data Services. Skills & Qualifications: Mr. Hooley brings previous service as a public company chief executive officer and director, deep experience in the financial services and healthcare industries and extensive business transformation and strategy expertise. | | | | | | Stericycle, Inc. - 2019 Proxy Statement | | | 15 | |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM Nominees for Director KAY G. PRIESTLY

Director Since June 2018 Age 62 Experience:Ms. Priestly served as Chief Executive Officer of Turquoise Hill Resources Ltd. from May 2012 until her retirement in December 2014. She previously served as Chief Financial Officer of Rio Tinto Copper, a division of the Rio Tinto Group, from 2008 until her appointment as Chief Executive Officer of Turquoise Hill Resources in 2012. From 2006 to 2008, she was Vice President, Finance and Chief Financial Officer of Rio Tinto’s Kennecott Utah Copper operations. She previously spent over 24 years with global professional services firm Arthur Anderson, where she provided tax, consulting and M&A services to global companies across many industries. She is a director of TechnipFMC plc and formerly served as a director and vice chairman of the board of directors of Ventana Medical Systems,New Gold Inc., FMC Technologies, Inc. SouthGobi Resources Ltd., Turquoise Hill Resources and Stone Energy Corporation(1). Skills & Qualifications: Ms. Priestly brings to our Board extensive executive management experience as a public company prior to its being acquired in February 2008. From January 1988 to March 1995, he was a general partner in a venture capital firm which he co-foundedchief executive offer and which led our pre-IPO funding. He was previously a partner in thesenior officer of major organizations with international operations. She also brings substantial business transformation, accounting, financial, risk management, M&A and consulting firm of McKinsey & Company, specializing in health care. Mr. Patience received B.A. and LL.B. degrees from the University of Sydney in Sydney, Australia, and an M.B.A. degree from the Wharton School of Business of the University of Pennsylvania.expertise. | (1) | When the Board appointed Ms. Priestly as a director in June 2018, it was aware that Stone Energy Corporation had filed for bankruptcy protection in 2016 while Ms. Priestly was serving as a director. The Board concluded that this event did not impair Ms. Priestley’s ability to serve as one of our directors. |

MIKE S. ZAFIROVSKI MIKE S. ZAFIROVSKI

Director Since November 2012 Age 6365 Mike S. Zafirovski has served as a director since November 2012.Experience: Mr. Zafirovski is the founder and presidentPresident of The Zaf Group LLC, a management consulting and investment firm established in November 2012. Mr. Zafirovski has also served as an executive advisor to The Blackstone Group, a private investment banking company, since October 2011. From November 2005 to August 2009, Mr. Zafirovski served as the presidentPresident and chief executive officerChief Executive Officer and a director of Nortel Networks Corporation. Prior to that, he was the presidentPresident and chief operating officerChief Operating Officer and a director of Motorola, Inc. from July 2002 to January 2005, and remained a consultant to and a director of Motorola until May 2005. He served as executive vice presidentExecutive Vice President and presidentPresident of the personal communications sector of Motorola from June 2000 to July 2002. Prior to joining Motorola, Mr. Zafirovski spent nearly 25 years with General Electric Company, where he served in management positions, including 13 years as presidentPresident and chief executive officerChief Executive Officer of five businesses in the consumer, industrial and financial services areas, his most recent being presidentPresident and chief executive officerChief Executive Officer of GE Lighting from July 1999 to May 2000. Mr. Zafirovski also serves as a director of The Boeing Company and two private companies (ApriaApria Healthcare Group Inc.

Skills & Qualifications: Mr. Zafirovski provides guidance to the Board on a wide variety of strategic, operational and non-executive chairman of the board for DJO Global, Inc.).business matters based on his substantial experience leading enterprises with significant international operations. He received a B.A. degree in mathematics from Edinboro University in Pennsylvania.also provides business transformation, information technology, mergers and acquisitions, healthcare industry, and government and regulatory expertise. Stericycle, Inc.The Board of Directors recommends a vote “FOR” the election of these ten Director nominees. Proxies solicited by the Board will be so voted unless stockholders specify a different choice. - 2017 Proxy Statement 14

Director Qualifications We believe that our 10ten director nominees possess the experience, qualifications and skills that warrant their election as directors. Our directors have in common, among other qualities, a breadth of business experience, seasoned judgment and an insistence on looking beyond the next quarter or the next year in directing and supporting our management. From their service on the boards of other public and private companies, our directors also bring to us the insights that they gain from the operating policies, governance structures and growth dynamics of these other companies. The Nominating and Governance Committee seeks to ensure an experienced, exceptionally qualified Board with deep expertise in areas relevant to Stericycle. When evaluating Our directors individually bringpotential director nominees, the committee considers each individual’s professional expertise and background, in addition to his or her personal characteristics. The committee always conducts this evaluation in the context of the Board as a wide rangewhole. The committee works with the Board to determine the appropriate mix of experience, backgrounds and knowledge. Among other thingsexperiences that each ofwill foster and maintain a Board strong in its collective knowledge and best able to perpetuate our directors brings: Mr. Miller brings a wealth of knowledge of our industry; Mr. Schuler brings experience managinglong-term success. To assist in this objective, the operations of a multinational healthcare companyNominating and knowledgeGovernance Committee conducts annual evaluations of the dynamicsBoard and the Board’s committees, assessing the experience, skills, qualifications, diversity, and contributions of each individual and of the healthcare industry; Mr. Alutto bringsgroup as a whole.

| | | | 16 | | Stericycle, Inc. - 2019 Proxy Statement |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM Director Qualifications The Nominating and Governance Committee regularly communicates with the Board to identify characteristics, professional experience and areas of expertise that will help meet specific Board needs, including: | • | | leadership experience, as directors who have served in significant leadership positions possess strong abilities to motivate and manage others and to identify and develop leadership qualities in others; |

| • | | business transformation experience, as we are engaged in a multi-year program to transform our company for long-term sustainability and drive profitable growth and long-term shareholder returns; |

| • | | public company board service and governance expertise, which provides directors with a solid understanding of their extensive and complex oversight responsibilities and |

| | furthers our goals of greater transparency, accountability for management and the Board and protection of stockholder interests; |

| • | | operational expertise, which gives directors specific insight into, and expertise that will foster active participation in the oversight of the development and implementation of our operating plan and business strategy; |

| • | | financial reporting,compliance and risk management expertise, which enables directors to analyze our financial statements, capital structure and complex financial transactions and oversee our accounting, financial reporting and enterprise risk management; and |

| • | | healthcare industry expertise, which is vital in understanding and reviewing our strategy. |

The following table highlights each nominee’s specific skills, knowledge and experiences in sales and marketing, operations, and general managementthese areas. A particular director may possess additional skills, knowledge or experience even though they are not indicated below: | | | | | | | | | | | | | | | | | | | | | | | | Anderson | | Bleil | | Chen | | Hackney | | Hagen | | Hooley | | Miller | | Murley | | Priestly | | Zafirovski | | | | | | | | | | | | Leadership experience (public company CEO/COO) | | | | | | | | ✓ | | ✓ | | ✓ | | ✓ | | | | ✓ | | ✓ | | | | | | | | | | | | | | | | | | | | | | | Public company Board service/governance expertise | | ✓ | | ✓ | | ✓ | | | | ✓ | | ✓ | | | | ✓ | | ✓ | | ✓ | | | | | | | | | | | | | | | | | | | | | | | Operational expertise (logistics/supply chain or capital intensive industry) | | | | | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | | | ✓ | | ✓ | | | | | | | | | | | | | | | | | | | | | | | Business transformation/IT expertise | | | | | | | | ✓ | | ✓ | | ✓ | | ✓ | | | | ✓ | | ✓ | | | | | | | | | | | | | | | | | | | | | | | Corporate strategy/M&A capability | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | | | | | | | | | | | | | | | | | | | | | | Financial reporting, compliance and risk management expertise | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | | | ✓ | | ✓ | | ✓ | | | | | | | | | | | | | | | | | | | | | | | Healthcare industry expertise | | ✓ | | ✓ | | ✓ | | ✓ | | | | ✓ | | | | ✓ | | | | ✓ | | | | | | | | | | | | | | | | | | | | | | | Government/regulatory experience | | | | | | ✓ | | | | | | ✓ | | ✓ | | | | | | ✓ | | | | | | | | | | | | | | | | | | | | | | | Talent management/HR expertise | | | | | | | | ✓ | | ✓ | | ✓ | | ✓ | | | | ✓ | | | | | | | | | | | | | | | | | | | | | | | | | Commercial/go-to-market expertise | | | | ✓ | | ✓ | | ✓ | | | | | | ✓ | | | | | | ✓ | | | | | | | | | | | | | | | | | | | | | | | International business expertise | | ✓ | | | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | | | | | | | | | | | | | | | | | | | | | | Gender, ethnic or other diversity | | ✓ | | ✓ | | ✓ | | | | ✓ | | | | ✓ | | | | ✓ | | | | | | | | | | | | | | | | | | | | | | | | | Tenure on Board (years, as of May 2019) | | 2 | | 4 | | 5 | | <1 | | 1 | | <1 | | <1 | | 2 | | 1 | | 7 |

| | | | | | Stericycle, Inc. - 2019 Proxy Statement | | | 17 | |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM Committees of our industry; Mr. Anderson brings financial experience from both healthcare and business products; Ms. Bleil brings significant expertise in the healthcare industry; Mr. Brown brings experience managing the operations of a multinational diagnostics business; Mr. Chen brings experience in managing and expanding the operations of a multinational nutrition business in Asia and emerging markets; Mr. Murley brings experience from the investment securities industry; Mr. Patience brings experience with public and private healthcare companies; and Mr. Zafirovski brings experience managing the operations of multinational communications and technology companies.Board When the Board elected Mr. Zafirovski as a director in November 2012, it was aware that Nortel Networks Corporation had filed for bankruptcy protection in January 2009 while Mr. Zafirovski was serving as its president and chief executive officer and a director. The Board concluded that this event did not impair Mr. Zafirovski’s ability to serve as one of the Company’s directors.

Committees of the Board Our Board of Directors has three standing committees: Compensation, Audit, and Nominating and Governance Committees. All of the members of each committee are outside directors who are independent under the applicable NASDAQSEC rules and Nasdaq listing standards. Compensation Committee The Compensation Committee makes recommendationsdetermines the structure, award and public disclosure of all elements of compensation and benefits paid to our CEO and other executive officers. The committee reviews and approves financial and strategic performance objectives with respect to our annual and long-term incentive plans. The committee reviews and approves the respective salaries of the Company’s executive officers in light of the Company’s goals and objectives relevant to each officer, including, as the committee deems appropriate, consideration of (i) the individual officer’s salary grade, scope of responsibilities and level of experience, (ii) the rate of inflation, (iii) the range of salary increases for the Company’s employees generally, and (iv) the salaries paid to comparable officers in comparable companies. The committee determines appropriate cash bonuses, if any, for the Company’s executive officers, after consideration of specific individual and Company performance goals and criteria and periodically reviews the aggregate amount of compensation and benefits being paid or potentially payable to the Board of Directors concerning the base salaries and cash bonuses of ourCompany’s executive officers and reviews our employee compensation policies generally.officers. The committee also administershas responsibility for overseeing the Company’s regulatory compliance with respect to compensation matters. Pursuant to the committee’s charter, the committee has responsibility for facilitating a risk review of incentive compensation programs and assessing if those incentives create risks that are reasonably likely to have a material adverse effect on our stock option plans as they apply to our executive officers. In addition,company. At the request of the Board, the committee periodically reviews executive leadership development and CEO succession planning and makes recommendations to our compensation practices to evaluate whether they pose enterprise or other risks to us.Board of Directors. Audit Committee The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities relating to the integrity of our financial statements, the qualifications and experience of our independent accountants, the performance of our internal audit function and our independent accountants, and our compliance with legal and regulatory requirements. The Audit Committee regularly reviews with the Company’s legal counsel any legal or regulatory matters that may have a material effect on the Company’s financial statements or operations. The Audit Committee also oversees, reviews and evaluates the adequacy and effectiveness of the Company’s compliance program. The Audit Committee reviews and evaluates the qualifications, performance and independence of our independent public accountants. The Audit Committee also reviews the performance, effectiveness and objectivity of the Company’s internal audit function, including its staffing, audit plan, examinations and related management responses. The Audit Committee reviews our risk management policies and practices and reports any significant issues to the Board. Matters of risk management are brought to the committee’s attention by our Executive Vice President and Chief Financial Officer, our Executive Vice President and General Counsel, our Executive Vice President and Chief Ethics and Compliance Officer, or by our principal internal auditor who focuses on potential weaknesses that could result in a failure of an internal control process.auditor. Our management reviews and reports on potential areas of risk at the committee’s request or at the request of other members of the Board. Nominating and Governance Committee The Nominating and Governance Committee develops, recommends to the Board and oversees the implementation of our corporate governance policies and practices. The committee monitors ongoing legislative and regulatory changes and initiatives pertaining to corporate governance principles, SEC disclosure rules and Nasdaq listing rules. The committee identifies and evaluates possible nominees for election to the Board of Directors and recommends to the Board a slate of nominees for election at the annual meeting of stockholders. The committee also recommends to the Board director assignments to the Board’s committees. In addition, As discussed above, the committee develops, recommends to the Board and oversees the implementation of our corporate governance policies and practices. The Nominating and Governance Committee considers a variety of factors in evaluating a candidate for selection as a nominee for election as a director. These factors include the candidate’s personal qualities, with a particular emphasis on probity, independence of judgment and analytical skills, and the candidate’s professional experience, educational background, knowledge of our business and healthcare services generally and experience serving on the boards of other public companies. In evaluating a

Stericycle, Inc. - 2017 Proxy Statement 15

candidate’s qualification for election to the Board, the committee also considers whether and how the candidate would contribute to | | | | 18 | | Stericycle, Inc. - 2019 Proxy Statement |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM Committees of the Board the Board’s diversity, which we define broadly to include gender and ethnicity as well as background, experience and other individual qualities and attributes. The committee has not established any minimum qualifications that a candidate must possess. In determining whether to recommend an incumbent director forre-election, the committee also considers the director’s preparation for and participation in meetings of the Board of Directors and the committee or committees of the Board on which the director serves. In identifying potential candidates for selection in the future as nominees for election as directors, the Nominating and Governance Committee relies on suggestions and recommendations from the other directors, management, stockholders and others and, when appropriate, may retain a search firm for assistance. In February 2019, the Nominating and Governance Committee retained a leading third-party search firm to assist with identifying potential director nominees. The committee will consider candidates proposed by stockholders and will evaluate any candidate proposed by a stockholder on the same basis that it evaluates any other candidate. Any stockholder who wants to propose a candidate should submit a written recommendation to the committee indicating the candidate’s qualifications and other relevant biographical information and providing preliminary confirmation that the candidate would be willing to serve as a director. Any such recommendation should be addressed to the Board of Directors, Stericycle, Inc., 28161 North Keith Drive, Lake Forest, Illinois 60045. In addition to recommending director candidates to the Nominating and Governance Committee, stockholders may also, pursuant to procedures established in our bylaws, directly nominate one or more director candidates to stand for election at an annual meeting of stockholders. A stockholder wishing to make such a nomination must deliver written notice of the nomination that satisfies the requirements set forth in our bylaws to the secretary of the Company not less than 90 days nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting of stockholders. If, however, the date of the annual meeting is more than 30 days before or after the first anniversary, the stockholder’s notice must be received no more than 120 days prior to such annual meeting nor less than the later of (x) 90 days prior to such annual meeting and (y) the close of business on the 10thday following the date on which notice or public disclosure of the date of the meeting was first given or made. Stockholders may also submit director nominees to the Board to be included in our annual proxy statement, known as “proxy access.” Stockholders who intend to submit director nominees for inclusion in our proxy materials for the 20182020 Annual Meeting of Stockholders must comply with the requirements of proxy access as set forth in our bylaws. The stockholder or group of stockholders who wish to submit director nominees pursuant to proxy access must deliver the required materials to the Company not less than 120 days nor more than 150 days prior to theone-year anniversary of the date that the Company first mailed its proxy materials for the annual meeting of the previous year. Process for Selecting Directors

Committee Charters The charters of the Compensation, Audit and Nominating and Governance Committees are available on our investor relations website,http://investors.stericycle.com. | | | | | | Stericycle, Inc. - 2019 Proxy Statement | | | 19 | |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM Committees of the Board Committee Members and Meetings The following table provides information about the current membership of the committees of the Board of Directors. | | | | | | | | | | | | | Director | | Compensation

Committee | | | CompensationAudit

Committee | Audit

Committee | | Nominating and

Governance

Committee | | Robert S. Murley(1) | | | | | | | | | | | | | Charles A. Alutto | | | | | | | | | | | | | Brian P. Anderson(2) | | | | | | |

| | | | | | Lynn D. Bleil | | |

| | | | | | | |

| | Thomas D. Brown(3) | | |

| | | | | | | |

| | Thomas F. Chen | | |

| | | | | | | |

| | J. Joel Hackney, Jr. | | | | | | | | | | |

| | Veronica M. Hagen | | | | | | |

| | | | | | Stephen C. Hooley | | |

| | | | | | | | | | Cindy J. Miller | | | | | | | | | | | | | Mark C. Miller | | | | | | | | | | | | | Kay G. Priestly(2) | | | | | | |

| | | | | | Mike S. Zafirovski(3) | | |

| | | | | Jack W. Schuler | | | | Charles A. Alutto |

| | | Brian P. Anderson(1) | |  * * | | Lynn D. Bleil |  | |  | Thomas D. Brown |  * * | |  | Thomas F. Chen | |  |  | Rod F. Dammeyer(1) | |  | | William K. Hall |  | | | Robert S. Murley | |  | | John Patience | |  | | Mike S. Zafirovski |  | |  |

| Member |

| (1) | Mr. Murley serves as the independent Chairman of the Board. |

| (2) | The Board of Directors has determined that Mr. Anderson, the intended ChairmanChair of the Audit Committee, following the Annual Meeting, and Mr. Dammeyer, the current Chairman of the Audit Committee,Ms. Priestly are “audit committee financial experts” as defined in the applicable SEC rules. |

Stericycle, Inc. - 2017 Proxy Statement 16

| (3) | Mr. Brown is not standing forre-election at the Annual Meeting, and we expect that Mr. Zafirovski will succeed him as Chair of the Compensation Committee at that time. |

Our Board of Directors held four18 meetings in person or by telephone during 20162018 and acted without a formal meeting on a number ofseveral occasions by the unanimous written consent of the directors. The Audit Committee held 1715 meetings during the year. The Compensation Committee held 12six meetings during the year. The Nominating and Governance Committee held fivesix meetings during the year. Each director attended at least 80%75% or more of the aggregate of the total number of Board meetings and the total number of meetings of all Board committees on which he or she served during his or her term of service. We encourage our directors to attend the annual meeting of stockholders. With the exception of Mr. Anderson and Mr. Murley who were not yet appointed to the Board at the time, eachEach of the director nominees attended the 20162018 Annual Meeting of Stockholders, and we anticipate that all of our directorsdirector nominees will attend this year’s Annual Meeting. Lead DirectorBoard Leadership

Our bylaws requireCompany’s Board of Directors does not have a current requirement that the roles of Chief Executive Officer and Chairman of the Board be either combined or separated because the Board believes it is in the best interest of our Company to make this determination based upon the position and direction of the Company and the constitution of the Board and management team. The Board regularly evaluates whether the roles of Chief Executive Officer and Chairman of the board should be combined or separated. As part of the evolution of the Board of Directors, to appointin March 2018, Mr. Murley, one of our outsideindependent directors, as the Lead Director if and when our president and chief executive, or any other officer or employee, is serving as the Chairman of the Board. The Lead Director is required to be independent under the NASDAQ listing standards, and serves at the Board’s pleasure until the next election of directors by the stockholders. Although Mr. Miller is no longer an officer of the Company, he is not independent under the applicable NASDAQ listing standards and therefore Mr. Schuler has continued as our Lead Director. Working with thewas elected Chairman of the Board, succeeding Mr. Miller. Mr. Miller is not standing forre-election as a director at the Lead Director is responsible for coordinatingAnnual Meeting.

The Chairman confers with our CEO on matters of general policy affecting theday-to-day management of our company’s business. The Chairman coordinates the scheduling and agenda of Board meetings and the preparation and distribution of agenda materials. The Lead DirectorChairman presides whenat all meetings of the Board meets in executive session or in the absence of the Chairman of the BoardDirectors and may call special meetings of the Board when he considers it appropriate. In general, the Lead DirectorChairman oversees the scope, quality, and timeliness of the flow of | | | | 20 | | Stericycle, Inc. - 2019 Proxy Statement |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM Board Leadership information from our management to the Board and serves as an independent point of contact for stockholders wishing to communicate with the Board other than through the Chairman of the Board. In August 2008, our Chairman of the Board, Jack W. Schuler, resigned as Chairman after serving for more than 18 years, and our Board appointed Mr. Schuler as our Lead Director, and he still serves in this position. Also in August 2008, the Board appointed our then President and Chief Executive Officer, Mark C. Miller, who had served in these positions for more than 16 years, to the additional position of Chairman of the Board. Effective January 2013, Charles A. Alutto became our President and Chief Executive Officer and Mr. Miller assumed the position of Executive Chairman of the Board, which he held until May 2016 when he transitioned in to the role of Chairman of the Board. At this time, theOur Board believes that thean independent Chairman together with the Lead Director, serveserves the Company well.and its stockholders well at this time. The combined experience and knowledge of Messrs. Alutto,Ms. Miller and SchulerMr. Murley in their respective roles of Chief Executive Officer,as CEO Elect and Chairman and Lead Director provide the Board and the Company with continuityaday-to-day focus on the operations of leadership that has enabled the Company’s successCompany combined with sufficient independent oversight of the Board throughand management. Ournon-management directors further facilitate the Board’s independence by meeting frequently as a group and fostering a climate of transparent communication. A high level of contact between our Lead Director.Chairman and Chief Executive Officer between Board meetings also serves to foster effective Board leadership.

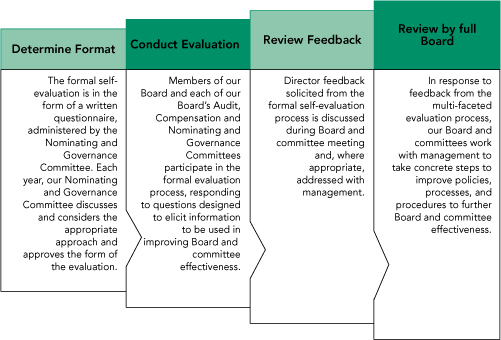

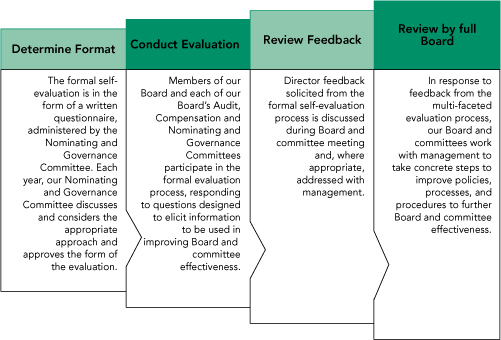

Corporate Governance Executive Sessions of the Board Our Board of Directors excuses Mr. Alutto, our President and Chief Executive Officer, as well as any of our other executive officers who may be present by invitation, from a portion of each meeting of the Board in order to allow the Board, with our Lead Director Chairman presiding, to review Mr. Alutto’s performance as President andthe Chief Executive OfficerOfficer’s performance and to enable each director to raise any matter of interest or concern without the presence of management. Board Evaluation Our directors annually review the performance of the Board of Directors and its committees and the performance of their fellow directors by completing a confidential evaluation forms that areis returned to Mr. Schuler as the ChairmanChair of the Nominating and Governance Committee. The evaluations elicit input from our directors with respect to the Company’s vision, strategy, and operating performance, our CEO and senior management, and the composition and management of our Board and its committees. The evaluations also seek input from members of the Board committees in such areas as trends and issues affecting the Company, the roles and responsibilities of the committee members, the makeup and composition of the committees, participation and preparation of the committee members and the effectiveness of the committees. Each director also has the opportunity to provide confidential feedback on each other director. At a subsequent meeting of the Board, Mr. Schulerthe chair of the Nominating and Governance Committee leads a discussion with the full Board of any issues and suggestions for improvement identified in histhe review of these evaluation forms.the director evaluations.

| | | | | | Stericycle, Inc. - 2019 Proxy Statement | | | 21 | |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM Corporate Governance Policy on Related Party Transactions The Board of Directors has adopted a written policy requiring certain transactions with related parties to be approved in advance by the Audit Committee. For purposes of this policy, a related party includes any director, director nominee or executive officer or an immediate family member of any director, director nominee or executive officer. The transactions subject to review include any transaction, arrangement or relationship (or Stericycle, Inc. - 2017 Proxy Statement 17

any series of similar transactions, arrangements and relationships) in which (i) we or one of our subsidiaries will be a participant, (ii) the aggregate amount involved exceeds $100,000 and (iii) a related party will have a direct or indirect interest. In reviewing proposed transactions with related parties, the Audit Committee considers the benefits to us of the proposed transaction, the potential effect of the proposed transaction on the director’s independence (if the related party is a director), and the terms of the proposed transaction and whether those terms are comparable to the terms available to an unrelated third party or to employees generally. There were no such transactions since January 1, 2016during the year ended December 31, 2018 that required the Audit Committee’s approval. Succession Planning The strength of our leadership team is critical to our Company’s short and long-term success. As such, the recruitment, development and retention of talented executives and senior leaders is a priority for the Company and the Board. On an annual basis, the Board devotes time during a dedicated session to discuss talent management and succession planning. Lead by our Chief People Officer, this session includes an overview of senior leaders across the Company’s service lines, global markets, and functional shared services up to and including the executive officers of the company. The Board is also given exposure to emerging, high-potential leaders through formal presentations to the Board and working groups with Board committees. Beyond the annual succession planning session, the Board is routinely updated on workforce matters including key workforce indicators, team member engagement, recruiting programs, and talent development programs. During 2018, Stericycle announced the appointment of Ms. Miller as President and Chief Operating Officer. The Board was heavily engaged in the recruitment and selection process for this role and leveraged the appointment of a new Chief Operating Officer to build a succession plan for the Chief Executive Officer role. With the announcement of Mr. Alutto’s retirement in February 2019, Ms. Miller was named Chief Executive Officer, effective May 2, 2019. Shareholder Engagement During 2018 and under the oversight of our Chairman of the Board, Stericycle expanded its efforts for engaging with shareholders. In addition to our Company’s previous monitoring and routine shareholder engagement practices, we introduced a proactive Board outreach program which focused on building relationships with our top 25 shareholders. Our expanded engagement program included outreach during the spring of 2018 and again in the fall to gain a broader understanding of shareholder priorities. During these conversations, our Board members reviewed our corporate governance enhancements, the refreshment of our Board of Directors, annually reviewsour executive compensation philosophy and approvesprogram, and the expansion of the leadership team, which have all significantly evolved over the past three years. Additionally, we solicited feedback from shareholders on our succession planning forprogress and responded to their questions and concerns. The outreach program provided our Chief Executive Officer,Board with useful input from our other executive officersshareholders. Transparency and a numberresponsiveness is an important component of other officers.our governance commitment to shareholders. We expect to continue to expand our engagement practices in order to monitor the insights of our shareholders and proactively solicit ways to evolve our business. Risk Oversight The Board regularly devotes time during its meetings to review and discuss the most significant risks facing the Company, and management’s responses to those risks. During these discussions, the Chief Executive Officer, Chief Financial Officer, General Counsel and other members of senior management present management’s assessment of risks, a description of the most significant risks facing the Company and any mitigating factors and plans or practices in place to address and monitor those risks. In addition, the Board conducts an annual, in-depth review of the Company’s business, which includes detailed analysis and consideration of strategic, operational, financial, competitive, compliance and compensation risk areas. Each Board committee addresses relevant risk topics as part of its committee responsibilities. The committees oversee the Company’s risk profile and exposures relating to matters within the scope of their authority and provide periodic | | | | 22 | | Stericycle, Inc. - 2019 Proxy Statement |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM Corporate Governance reports to the full Board about their deliberations and recommendations. The Audit Committee reviews with management significant risks and exposures identified by management, our internal audit staff or the independent accountants, and management’s steps to address these risks. The Compensation Committee is responsible for overseeing the management of risks relating to the Company’s executive compensation plans and its overall compensation philosophy. Responsibility for risk management flows to individuals and entities throughout our Company as described above, including our Board, Board committees and senior management. We believe our culture has facilitated, and will continue to facilitate, effective risk management across the Company. Required Resignation on Change in Job Responsibilities The Board of Directors has adopted a policy that a director must tender his or her resignation if the director’s principal occupation or business association changes substantially from the position that he or she held when originally elected to the Board. The Nominating and Governance Committee will then review the circumstances of the director’s new position or retirement and recommend to the full Board whether to accept or reject the director’s resignation in light of the contributioncontributions that he or she can be expected to continue to make to the Board. Director Tenure In order to assist with Board refreshment and in bringing fresh ideas and perspectives to the Board, in March 2019, the Board revised our Corporate Governance Guidelines with respect to director tenure. The revised Guidelines generally provide that nonon-management Director may be nominated to serve a new term if he or she has already served on the Board for 15 years at the time of election. The Board of Directors may make exceptions to this policy on acase-by-case basis. Anti-Hedging and Anti-Pledging Policy Our directors, executive officers and other designated employees are prohibited from engaging in certain transactions inwith respect ofto our common stock including hedging transactions, derivative transactions and short sales. In addition, these personsexecutive officers and other designated employees are prohibited from holding our common stock in a margin account or otherwise pledging our common stock as collateral for a loan. In March 2019, our Board amended our policy to also prohibit our directors from holding our common stock in a margin account or otherwise pledging our common stock as collateral for a loan. Clawback Policy In order to encourage sound financial reporting and enhance individual accountability, we have adopted a clawback policy that allows us to recover from our executive officers certain performance-based compensation in the event of certain accounting restatements. If we are required to prepare a restatement of our financial statements due to material noncompliance with any financial reporting requirement under the securities laws, the Compensation Committee willmay seek to recover from a covered officer certain performance-based compensation if the covered officer is determined to have engaged in fraud or intentional misconduct that materially contributed to the need for the restatement or if otherwise required by applicable SEC or NASDAQNasdaq rules. 10b5-1 Trading Plan Guidelines In March 2019, our Board adopted guidelines with respect to trading plansStericycle, Inc.(“10b5-1 - 2017 Proxy Statement 18Plans”) adopted by employees or directors pursuant to Rule10b5-1 of the Securities Exchange Act of 1934, as amended (the“10b5-1 Plan Guidelines”). These10b5-1 Plan Guidelines are in addition to the requirements and conditions of applicable law and other Company policies, including our Securities Trading Policy. The10b5-1 Plan Guidelines require that10b5-1 Plans be approved by our General Counsel or his designee and that they only be adopted or amended while a trading blackout is not in effect. The10b5-1 Plan Guidelines provide for a “cooling off” period of at least 30 days before trades can occur after adoption or amendment of a10b5-1 Plan and before adoption of a new plan after early termination of an existing10b5-1 Plan. Our10b5-1 Plan Guidelines also set restrictions on the number of10b5-1 Plans a covered individual may have in effect, trading outside of an existing10b5-1 Plan and the length of time a plan may be in effect. | | | | | | Stericycle, Inc. - 2019 Proxy Statement | | | 23 | |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM Corporate Governance Internal Controls Under the oversight of the Audit Committee, we have implemented an Internal Control Transformation Program to address historical material weaknesses. We highlight below significant remediation activities undertaken in 2018. Financial Reporting Controls: In connection with our Internal Control Transformation Program, we have continued to focus on improving our overall control environment. Our remediation actions related to improving the controls over our financial statement preparation and reporting process included the following: The Audit Committee and our company’s management have frequent communications regarding our financial reporting and internal control environment. We expanded our finance, accounting and information technology teams through the addition of experienced and qualified personnel. We aligned incentive plans with sustained effective internal controls over financial reporting and management continuous control monitoring. Our company provided additional internal controls training to our employees and standardized policies and controls where feasible. Were-designed and harmonized our control objectives across all processes and locations. Were-designed and enhanced our delegation of authority policy and processes, including implementing a systematic enabled work flow. Our company implemented a central repository for policies and quarterly checklists to confirm adherence with policies. We instituted monthly legal entity and management reporting reviews of financial statements disaggregated by key business units, regions and functional areas, to evaluate results, observe adherence to policies and agree on necessary actions to be taken before considering the period closed. Management of the respective areas meets with our corporate executives monthly in connection with these reviews. We expanded our technical accounting group that has responsibility to ensure that the accounting for complex ornon-routine transactions is appropriate. We expanded our use of specialists to assist with highly complex and technical areas of accounting, valuation and new accounting standards adoption. We enhanced our Disclosure Committee processes and reviews by adding experienced and knowledgeable members to the committee and implementing disclosure surveys to capture input from appropriate areas and levels throughout the organization. General Information Technology Controls (GITCs): During the course of 2018, we made progress in advancing foundational elements of our general information technology controls. Our remediation actions related to our GITC environment included the following: We established policies, trained personnel and implemented policies and procedures over logical access and general information technology controls. We automated user access reviews. We implemented policies and mitigating controls over incompatible segregation of duties within our information technology systems. Monitoring Activities: Our remediation actions related to monitoring our internal controls over financial reporting included the following: Enhanced control activities within our process to recognize revenue, including: Leveraging advanced technology to substantively evaluate and monitor revenue, accounts receivable, cash receipts and other accounts and activities associated with revenue recognition. Implementing a monitoring control which leverages advanced analytical processes to evaluate the appropriateness of revenue related transactions across key business units. Implementing systematic segregation of duties through system enabled work flow. Developing and implementing continuous monitoring of global financial reporting controls.

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM Corporate Governance When fully implemented and operational, we believe the controls we have designed or plan to design will remediate the control deficiencies that have led to the material weaknesses we have identified and strengthen our internal controls over financial reporting. Code of Conduct The board has adopted a Code of Business Conduct and Ethics that sets forth standards regarding matters such as honest and ethical conduct, compliance with law, and full, fair, accurate, and timely disclosure in reports and documents we file with the SEC and in other public communications. The Code of Business Conduct and Ethics applies to all of our employees, officers and directors, including our principal executive officer, principal financial officer and principal accounting officer. The Code of Business Conduct and Ethics is available at our website,www.stericycle.com,and is available free of charge on written request to Investor Relations, Stericycle, Inc., 28161 North Keith Drive, Lake Forest, IL 60045. Any amendments to certain provisions of the Code of Business Conduct and Ethics or waivers of such provisions granted to certain executive officers will be disclosed promptly on our website. Section 16(a) Beneficial Ownership Reporting Compliance Section 16(a) of the Securities Exchange Act of 1934, as amended requires our directors, executive officers and persons beneficially owning more than 10% of our outstanding common stock to file periodic reports of stock ownership and stock transactions with the SEC. During 2017 and 2018, due to the failure of an investment advisor with discretionary authority to inform Mr. Anderson of certain transactions in our common stock, Mr. Anderson failed to timely file eleven forms 4 to report eleven transactions. In addition, due to administrative oversight by the Company, Mr. Brown and Mr. Chen each failed to timely file a form 4 to report the conversion of depositary shares into shares of our common stock and Mr. Richard Hoffman failed to timely file a form 4 to report grants of stock options, time-based restricted stock units (“RSUs”) and performance-based RSUs. Additional Information We will provide a copy of our Annual Report on Form10-K for the fiscal year ended December 31, 2018 without charge to each stockholder as of the record date who sends a written request to Investor Relations, Stericycle, Inc., 28161 North Keith Drive, Lake Forest, Illinois 60045. Copies of this proxy statement and our Form10-K as filed with the SEC are available in .pdf format on our investor relations website,http://investors.stericycle.com.Copies of this proxy statement and our Annual Report on Form10-K also may be accessed directly from the SEC’s website,www.sec.gov. Communications with the Board Stockholders and other interested parties who would like to communicate with the Board may do so by writing to the Board of Directors, Stericycle, Inc., 28161 North Keith Drive, Lake Forest, Illinois 60045. Our Investor Relations department will process all communications received. Communications relating to matters within the scope of the Board’s responsibilities will be forwarded to the Chairman of the Board and, at his direction, to the other directors. Communications relating to ordinaryday-to-day business matters that are not within the scope of the Board’s responsibilities will be forwarded to the appropriate officer or executive. Communications addressed to the Lead Director will be forwarded to him and, at his direction, to the other directors, and communications addressed to a particular committee of the Board will be forwarded to the chair of that committee and, at his or her direction, to the other members of the committee. | | | | | | Stericycle, Inc. - 2019 Proxy Statement | | | 25 | |

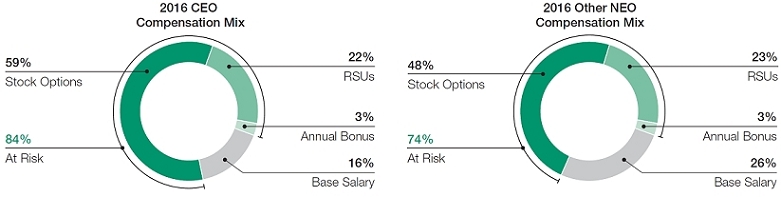

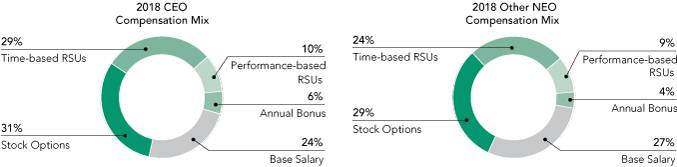

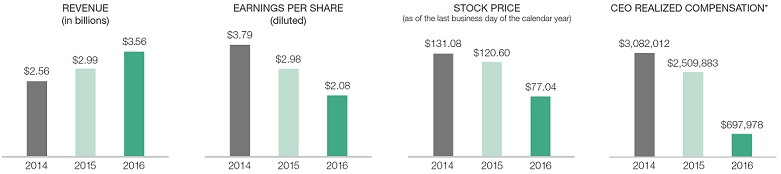

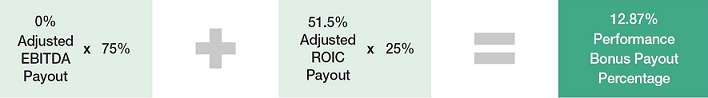

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM Director Compensation Director Compensation in 2016 In February 2016, the Board modified our Outside Directors Compensation Plan to align the compensation of ourFor 2018, each outside directors with the changes made to the compensation of our executive officers and with the market generally. Our goal in making such changes was to provide compensation that aligned with the median compensation awarded by our peers to ensure we can continue to attract and retain a high caliber board of outside directors. These changes became effective in 2017 and are described below under “Compensation Plan for 2017 and 2018”.

Each director’s compensation for 2016 was $125,000 (the “annual retainer”) whichconsisted of an annual cash retainer of $80,000 and an annual equity retainer of $125,000. Unless deferred, the annual equity retainer was paid primarilyentirely in stock options. Directors who had already satisfied our stock ownership guidelines could elect to receive full or partial payment of the annual retainer in cash. One director chose to receive the retainer in cashtime-based RSU’s which was paid in twelve equal monthly installments. All other directors received their annual retainer in two pieces: (i) a stock option reflecting the conversion of 75%, or $93,750, of the annual retainer, and (ii) a time-based RSU award reflecting the conversion of the remaining 25%, or $31,250. Directors have received new option and RSU awards each year when elected, or reelected, at the annual meeting of stockholders, including the annual meeting held in 2016. The 2016 awards vest on May 25, 2017, the first anniversary of the grant date.

Mr. Hall elected We also paid the following retainers to receive his 2016 annual retainer in cash. This included andirectors with additional $5,000 awarded for his serviceresponsibilities as the Chairman of the Board or the Chair of a committee:

Chairman of the Board – $50,000 cash and $50,000 in RSUs Chair of the Audit Committee – $20,000 Chair of the Compensation Committee. Mr. Dammeyer received an additional $10,000, deliveredCommittee – $15,000 Chair of the Nominating and Governance Committee – $12,500 Under the terms of the Director Compensation Plan, directors may elect to convert all or a portion of the annual cash retainer to time-based RSUs. Directors may also elect to defer receipt of any or a portion of their annual director compensation and convert such compensation to deferred stock units (DSUs). DSUs are generally payable in the form of 297 options and 40 RSUs, for his service as Chairmanshares of the Audit Committee.our common stock within a certain period after a director’s death or other separation from service. We did not pay any other fees or other cash compensation to our directors who served during 20162018 or provide them with any perquisites or other personal benefits. Directors are not paid separate fees for attending meetings of the Board of Directors or its committees, and no fees were paid to the Chairman of the Board for his service as chairman.committees. Compensation Plan for 2017 and 2018

At the request of the Nominating and Governance Committee, the Compensation Committee engaged Deloitte Consulting LLP as an independent compensation consultant during 2016 to benchmark Stericycle’s compensation plan for its Board of Directors. Based on peer benchmarking data provided by the compensation consultant, the Compensation Committee determined that Stericycle’s outside directors were not compensated on par with their counterparts at other companies in our peer group or in the market generally.

Stericycle’s outside director total compensation in 2016 was 37% below the peer group median, and Stericycle was one of only three companies in our peer group to award options as the predominant form of director compensation. In order to remedy that disparity so Stericycle can continue to attract a diverse group of experienced professionals to serve on the Board, the Compensation Committee recommended adding a cash component to the Outside Directors Compensation Plan in 2017 that would bring the compensation program in alignment with the median of our peers. The Board opted to adjust director compensation in two stages over 2017 and 2018.

Beginning in 2017, directors will receive a cash retainer of $40,000 and an annual equity award of $125,000 in the form of time-based RSUs. We will continue to pay an additional $10,000 to the Chairman of the Audit Committee, and $5,000 to the Chairman of the Compensation Committee. Should a director join the Board mid-year, that individual will receive compensation that is pro-rated for the portion of the year he or she will be in active service to the Board.

Beginning in 2018, the directors’ annual cash retainer will increase to $80,000 and the annual equity award will remain at $125,000 delivered entirely in time-based RSUs. In addition, we will pay the following additional retainers beginning in 2018 to be more in line with our peer group:

• | Chairman of the Audit Committee—$20,000 | | | • | Chairman of the Compensation Committee—$15,000 | | | • | Chairman of the Nominating and Governance Committee—$12,500 | | | • | Lead Director—$25,000 |

Stericycle, Inc. - 2017 Proxy Statement 19

The following table provides information about the compensation paid to our directors in 2016.2018. Neither Mr. Alutto nor Mr. Miller* receiveMs. Miller received any additional compensation for his or her services as a director. In addition, Mr. Hackney and Mr. Hooley were not directors during 2018 and did not receive any director compensation during that year. | Name | | Fees Earned

or Paid in

Cash | | | Stock

Awards | | | Option

Awards | (1) | | Non-Equity

Incentive Plan

Compensation | | | All Other

Compensation | | | Total | | | Jack W. Schuler, Lead Director | | $ | – | | | $ | 48,247 | | | $ | 71,289 | | | | – | | | | – | | | $ | 119,536 | | | Lynn D. Bleil | | | – | | | | 48,247 | | | | 71,289 | | | | – | | | | – | | | | 119,536 | | | Thomas D. Brown | | | – | | | | 48,247 | | | | 71,289 | | | | – | | | | – | | | | 119,536 | | | Thomas Chen | | | – | | | | 48,247 | | | | 71,289 | | | | – | | | | – | | | | 119,536 | | | Rod F. Dammeyer(2) | | | – | | | | 52,146 | | | | 76,992 | | | | – | | | | – | | | | 129,138 | | | William K. Hall(3) | | | 130,000 | | | | – | | | | – | | | | – | | | | – | | | | 130,000 | | | John Patience | | | – | | | | 48,247 | | | | 71,289 | | | | – | | | | – | | | | 119,536 | | | Mike S. Zafirovski | | | – | | | | 48,247 | | | | 71,289 | | | | – | | | | – | | | | 119,536 | |

| | | | | | | | | | | | | | Name | | Fees Earned

or Provided

in

Cash | | | Stock